Budget 2023-24 sets out a series of social aids aimed at ensuring the protection of the most vulnerable of the society, aligned with the guiding principle of the Government, that is, to care for the population.

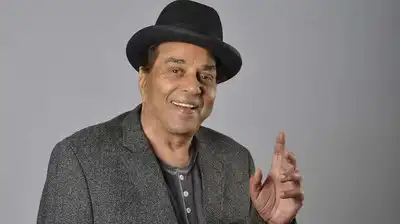

The Minister of Finance, Economic Planning and Development, Dr Renganaden Padayachy, elaborated this evening, on each support measure catered for the most vulnerable groups, as follows:

Social Aid

The Finance Minister announced an increase in the threshold for eligibility of monthly benefits under the Social Register of Mauritius (SRM) aimed at supporting the most vulnerable of our society, from Rs 3000 to Rs 3,575 for an adult; and from Rs 1,500 to Rs 2,500 for a child. The maximum household income threshold will increase from Rs 10,500 to Rs 14,650 as from the 1st of July 2023.

In the same spirit, he indicated that the income threshold for registration under the National Database for Vulnerable Groups is being reviewed from Rs 4,000 to Rs 4,600 for an adult; and from Rs 2,000 to Rs 3,220 for a child. Therefore, households earning a monthly income above Rs 14,650 and not exceeding Rs 18,860 will be eligible for support under the National Database for Vulnerable Groups.

As for the Crèche Allowance for SRM beneficiaries, the Budget 2023-24 caters for an increase from Rs 2,000 to Rs 3,000. Besides, the Budget makes provision for the purchase wheelchairs, spectacles, hearing aids and dentures for Households earning up to Rs 35,000 monthly instead of Rs 30,000. In addition, the monthly incontinence allowance of Rs 1,800 will be extended to patients suffering from cancer of prostate, cancer of bladder, Alzheimer’s and stroke.

Non-Governmental Organisations

Dr Renganaden Padayachy renewed this evening, his support to Non-Governmental Organisation (NGOs) for their contribution for our communities and people, and announced key budgetary measures to further strengthen the collaboration between the Government, private sector and NGOs.

The Minister informed that a budget of Rs 500 million has been mobilised for the next 5 years to implement national social projects including, the construction of residential care institutions for children in distress; provision of a vulnerable youth programme for some 6,000 students;s etting up of 2 Halfway Homes for children coming out of Correction Youth Centres; and programmes for homeless persons, elderly persons living alone and rehabilitation of ex-detainees.

Furthermore, the Budget will support the launch of a 1 million hours of “Volontariat pou Moris” campaign by the National Social Inclusion Foundation in collaboration with NGOs.

As for companies donating to NGOs involved in supporting persons with health issues and disabilities, protection of street children and rehabilitation programmes, they will be allowed a triple deduction on their contribution up to a maximum of Rs 1 million, informed the Finance Minister.

Budget 2023-24 also caters for a duty-free vehicle for NGOs registered with the NSIF.

Religious bodies

The Finance Minister also announced an increase in the grant to religious bodies , from Rs 108 million to Rs 125 million, as well as the provision of a one-off grant of Rs 10 million. Provision as also been made in the 2023-24 Budget, to remove the municipal tax on halls and buildings owned by religious bodies.

Animal Welfare

Dr Renganaden Padayachy emphasised on one of the objectives of the Government, that is to promote animal welfare in the community, to which end, the Budget makes provision for the following measures:

The triple deduction on donations by companies will be extended to contributions to NGOs looking at animal welfare and protection; and individuals adopting animals from registered NGOs will be allowed to deduct an amount of Rs 10,000 on their chargeable income for each animal adopted.